5 Digital Marketing Strategies for Banks and Financial Service Providers

I began my career in the financial industry, working at both local and national institutions. I dealt with sales and new accounts, and quickly realized that almost all of the business was due to “word of mouth”, past relationships and the branch locations. Marketing strategies for the banks were confined to traditional radio, TV and newspaper advertisements– inbound marketing was largely unutilized.

At the time, the digital landscape was growing, which required banks to make certain adjustments in their services and offerings. Online and mobile banking quickly grew from being perks to being necessities for many customers, yet it seemed as though banks were just doing the minimum when it came to engaging their consumer bases online– and they were missing out on what the Internet can offer.

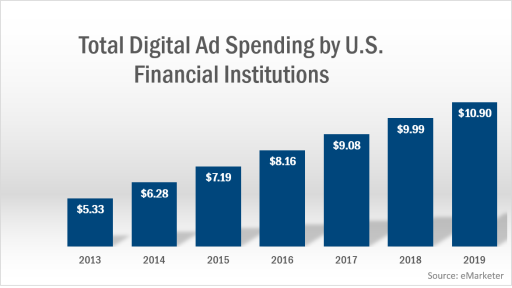

There is a reason that over half of all ad dollars are spent on digital marketing and why large companies are investing more money in online marketing than ever before. The digital ecosystem provides brands with an effective way to reach people. As a company, you can see exactly what you are getting for your money and you can use data from your marketing endeavors to improve and optimize your digital marketing strategies.

To remain competitive for the modern consumer, banks need to set aside a larger budget for online initiatives such as digital ads, content marketing and search engine optimization. These are investments that will lead to new customers and an increase in brand recognition. Brands should understand that putting digital marketing to work does not guarantee an overnight fix. It requires a long term strategy of building relationships with customers and integrating your company in the online world. If you are looking for a trusted vendor and an experienced team to help you with your digital marketing initiatives, contact me today. Here are 5 digital marketing strategies for banks and financial service providers.

1. Search Engine Optimization (SEO)

The goal of SEO is to be there when people are looking for you. Think for a moment about the products you sell– such as loans, checking/savings accounts and mortgages. Before customers make a purchase, they are spending their time researching options and learning more about the product. Think about what you would do if you were interested in refinancing a mortgage. Chances are, you would begin by searching: ‘home refinancing rates’. In SEO, your goal is to be there to answer these questions for customers online so that they trust you and view you as the financial leader with whom they want to do business.

As a financial institution, your goal should be to be on the first page of Google search results when someone searches for banks in your city. Research has indicated that more than half of your traffic comes through organic search, meaning people just clicking on links through Google or another major search engine. For your marketing efforts to be successful, you need to be visible on search engine results pages.

To get a website to rank highly on search engines, you need to communicate that your website provides value for customers. That means that the language you use in your content should match the vocabulary employed by your consumer base. It also means that your content should be thorough and provide meaning for a person clicking on the page.

SEO also involves optimizing pages, such as using keywords in the meta description, the page title and the URL. Try and build quality backlinks to your page by promoting your content through social media. Google looks at criteria such as the amount of time people spend on the website, the number of readers, how easy it is for users– and the Google spiders– to understand the site and how well it lines up with user queries when determining ranking.

2. Content Marketing

When customers search online, they are looking for content. They want to find a brand that will answer their question and provide them with value. If you regularly produce articles on topics that customers appreciate, you will be able to generate more traffic from search and encourage people to engage with your site. Your content might include pieces such as tips for first time homebuyers or an announcement about CD increases.

Your content can also be used in other marketing and promotional materials, such as your social media sites and email newsletters. Use these sources to introduce people to your material and encourage them to further engage with you on the website.

Services like ContentTools can also help you secure articles on behalf of your officers, which can then be posted on LinkedIn pages. These postings help to build the authority around your officers and encourage people to contact them with questions or possible leads.

Use the content also as a means of encouraging people to continue to build the relationship. For example, a person reading an article about being a first-time homebuyer is likely interested in making a purchase. Invite them at the end of the content to speak with a specific representative at your institution for more information.

3. Digital Advertising

About 1/2 of all the ad dollars spent in the US are spent on Google. This is because it works. If you are not utilizing this valuable resource, you are missing out on potential customers. When you create an advertisement with traditional advertising, you are forced to rely on the ‘spray and pray’ philosophy– hoping that it gets in front of the right people. When you advertise online, it is easier to target specific demographics and to personalize the message they see. You can collect data from your campaigns and use this information to optimize your advertisements and therefore get more for your money.

4. Email Newsletters

You want to have multiple opportunities for people to opt in to your email list. When you set up new accounts, you can collect email addresses. You can also have forms on your website for people who find your content valuable and informative. Use these regular email newsletters to keep people engaged with your brand. Include relevant, interesting articles you are producing. Send out announcements about new hires, events and community outreach with which your institution is involved. Email remains a highly effective means of keeping in touch with people– roughly 91 percent of people with email check their inboxes at least once per day. Build brand loyalty and upsell your products through a regular, valuable newsletter. For more information regarding email marketing, check out this article: 5 Keys to Exceptional Email Marketing for Financial Institutions.

5. Make Your Website Usable and Mobile Friendly

Most millennials will begin a purchase decision with a web search. If people land on a website that is difficult to navigate, however, you will have a significantly harder time making them a customer. An estimated 50 percent of sales are lost because site visitors cannot find the information they seek. Your website should be designed to be an extension of your sales team– it will often serve as the first point of contact between customers interested in your products and services and your brand. It is key to landing new customers.

Mobile is also crucial. Mobile searches now exceed desktop searches as people use their mobile devices to search for things while on the go. In April 2105, Google also launched an algorithm update that penalizes websites that are not mobile friendly. Mobile friendly means being easy-to-use on a mobile device, and not just being a miniature version of the desktop site. You should think about the goals that people often have on their mobile devices, such as searching for a contact number, the nearest branch or an ATM. Make this information easy to find on the mobile site with a minimum number of steps. Buttons should be easy to use on a touch screen and they should not be too close together, either.

Financial institutions need to grow beyond old forms of advertising, such as TV or newspaper advertisements. Customers are online, and banks need be there to engage them and build the relationships that lead to brand loyalty and growth. Those ready to take the plunge into modern advertising should reach out to me today to get started.